Secure Order Form

It’s time to take action: You could have less than 60 days to secure your money before Britain’s Shadow Currency blows up again

To claim a year of membership to The Fleet Street Letter – and your four research reports simply enter your information into the secure order form below

You’re about to make a very smart move.

Two years ago, every British investor and saver got what should have been a big wakeup call.

Liz Truss’ government issued one “mini” budget… and almost crashed the entire financial system.

Without the Bank of England’s printing press… millions of people were hours away from seeing their pension fund go bust.

We escaped last time… just.

But next time, we may not be so lucky.

That’s the problem when your financial system is built on nothing but trust. It can vanish in an instant, with dramatic consequences.

Now with Keir Starmer and Rachel Reeves preparing his first budget – with everything from wealth taxes to sweeping new nationalisations on the table – it’s critical you take action to prepare.

That’s what our experts at The Fleet Street Letter are here to do.

You’re moments away from claiming your four special reports that could help you protect and even grow your wealth during what could be some of the darkest times in recent history for British investors.

Here’s a recap of all you’ll receive today:

- Special Report #1: The 21st Century Stinnes Plan: Hugo Stinnes turned the nightmare of Weimar hyperinflation into an opportunity – he grew rich, where most others suffered. In this report, you’ll see how you could position your wealth using the same principle. Remember: someone always comes out of a crisis wealthier than they went in. The secret is preparation – and making the right moves at the right time. In this report you’ll see what moves our experts suggest you make immediately.

- Special Report #2: The Gold Report: why every investor should own gold now. Right now, the elite are turning to gold in a big way. The Dutch Central Bank is even talking about an all-out collapse of the financial system. In a situation like that you need gold. And this report shows you the smartest and simplest ways to own it.

- Special Report #3: What to do With Your Money Right Now: There are a handful of UK-listed stocks out there that our experts still rate as “BUYS”. In this report you’ll discover what they are – and why we’re expecting them to go up in the coming weeks and months, no matter what happens to the UK economy.

- Special Report #4: The Trade of the Decade: There’s one trade you can place today that’ll set you up for huge potential returns over the next 5-10 years. It’s already beginning to pay off for investors. But we think there’s more to come. You’ll get the full story in this report.

Remember, The Fleet Street Letter has a storied history of alerting readers to impending disaster, even as millions sleepwalked into the calamities of the last century.

As you’ve seen, in 1938 The Fleet Street Letter’s founder Patrick Maitland went to Europe to gather information on Nazi Germany’s and Fascist Italy’s true intentions… and reached the grim conclusion that appeasement would not work.

His 1938 warning that war was inevitable can still be found in a vault in St Pancras, London:

In 1987, we predicted that the Soviet Union would collapse. A few years later, that’s exactly what happened as the Berlin Wall fell.

In 1997, two of our experts published one of the most influential books of all time… The Sovereign Individual. In it, Lord Rees Mogg (former editor the Times and father of the MP Jacob), and James Dale Davidson (a close friend of Bill Clinton’s) predicted “a new digital form of money […of…] encrypted sequences… unique, anonymous and verifiable”. In other words: bitcoin...

In 2000, we warned that a “day of reckoning” was at hand for the dot-com boom... the very day the NASDAQ began a two-year, 77% decline.

In 2008, we warned that “the City’s dream run is about to end… and it could trigger our worst recession in 35 years.” Five and a half months later Lehman Brothers collapsed.

In 2021, our experts warned readers about a bloodbath in store for the bond market… and sure enough, Forbes would later call 2022 “the worst year ever” for bonds.

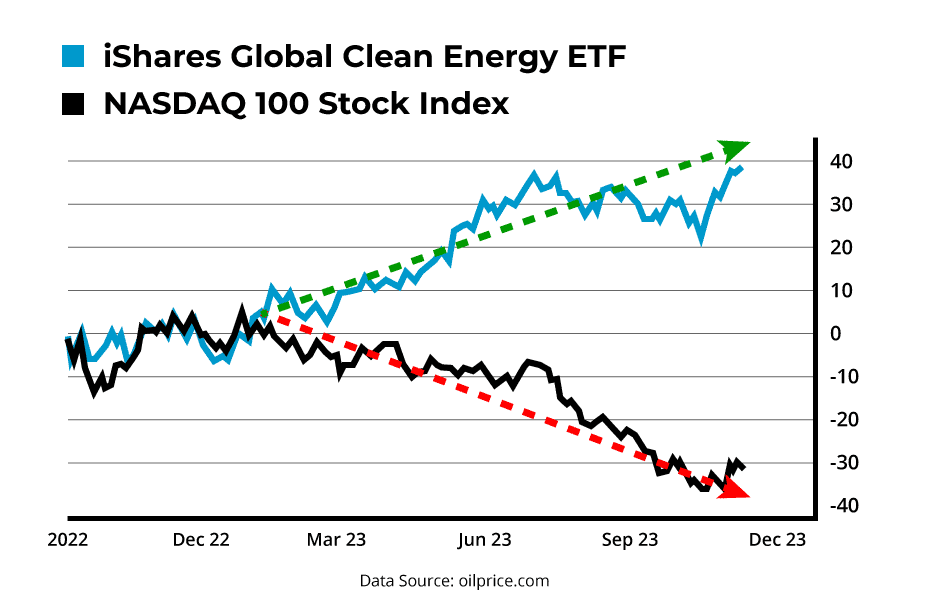

And called out the bubble in green energy stocks…

Sure enough, clean energy stocks went on to collapse, even as the broader stock market took off:

Past performance is not a reliable indicator of future results

Not only that, but Editor Nick Hubble was able to point some of his readers towards two nuclear energy stocks, after predicting a comeback in the sector in January 2023.

Past performance is not a reliable indicator of future results.

Two of those energy recommendations, Rolls-Royce Holdings and Boss Energy Limited, rose 45% and 530%, respectively.

But all of that is old news…

What’s about to happen to millions of UK families right now is far more important.

That’s why we’re giving you the chance to join The Fleet Street Letter for just £79 for your first year.

Time to act

There are three different membership levels on the table for you today – standard, premium and deluxe.

Standard membership gets you access to everything we’ve just laid out for you.

Premium membership gets everything included in standard, plus an extra bonus report called Confidence Trick: Five Toxic Time Bombs to Sell Now. This report could help you avoid making a terrible mistake with your money in the near future.

Deluxe membership gets everything covered above, plus ANOTHER bonus report called How The Euro Dies – an explosive expose of how the political situation in France, Germany and Italy could soon trigger a breakup of the Eurozone and the death of the single currency. If you have a single pound invested in the stock market you need to know how this will impact you – this report explains it all.

It’s entirely up to you which level of membership you choose.

Just select the level you want below.

Whichever option you choose, you’ll also gain access to two regular and extremely informative emails:

Southbank Sunday Brunch

Your essential weekend read for sharp market insights, expert analysis, and thought-provoking ideas.

Each Sunday, we’ll break down the key trends shaping the economy and markets - helping you make sense of what’s happening and, more importantly, how to turn it to your advantage.

With over 20 years in financial publishing, I’ve worked alongside some of the sharpest minds in the industry. Now, I’ll be bringing you the best insights from our team at Southbank Investment Research - including John Butler, Sam Volkering, and James Allen.

Fortune & Freedom

Intelligent insight, in plain English, about the threats to your money and how to avoid them. You’ll get the truth about your money – behind the headlines, jargon and spin.

Totted up, you’ll have unrestricted access to hundreds of pounds' worth of valuable financial ideas, wisdom and investment recommendations.

Simply select the level of membership you want, fill out the secure order form below and hit ‘Continue’ to start your subscription.

We look forward to welcoming you on board.

Important note: Your subscription comes with our automatic-renewal feature. This feature ensures that you will never miss an issue. Currently The Fleet Street Letter renews at £249 per year from your second year onwards. You may opt out of this auto-renew feature at any time after your purchase.

Important note: Your subscription comes with our automatic-renewal feature. This feature ensures that you will never miss an issue. Currently The Fleet Street Letter renews at £249 per year from your second year onwards. You may opt out of this auto-renew feature at any time after your purchase.

Fill Out the Order Form Below or Call 0330 808 7916

By clicking Subscribe Now, you agree to be bound by our terms and conditions, which can be viewed by clicking the link at the bottom of the page

Important Risk Warning

Advice in The Fleet Street Letter does not constitute a personal recommendation. Any advice should be considered in relation to your own circumstances, investment objectives and risk tolerance. Before investing you should consider carefully the risks involved, including those described below. If you have any doubt as to suitability or taxation implications, seek independent financial advice.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid.

Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds – Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment.

Unregulated investments - The Financial Conduct Authority does not regulate certain activities, including the buying and selling of commodities such as gold. This means that you will not have the protection of the Financial Ombudsman Service or the Financial Services Compensation Scheme.

Taxation – Profits from share dealing, including both capital gains and dividends, are subject to capital gains tax and income tax respectively. Capital gains from commodities are subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change in the future.

Investment Director: John Butler. Editor-in-Chief: Nick Hubble. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of Southbank Investment Research Ltd. Full details of our complaints procedure and terms and conditions can be found at, www.southbankresearch.com.

The Fleet Street Letter contains regulated content and is issued by Southbank Investment Research Limited. Registered in England and Wales No 9539630. VAT No GB629728794. Registered Office: Basement, 95 Southwark Street, London, SE1 0HX.

Contact Us: To contact customer services, please call us on 0203 966 4580, Monday to Friday, 10.00am - 5.00pm.

Southbank Investment Research Limited is authorised and regulated by the Financial Conduct Authority. FCA No 706697. https://register.fca.org.uk/.

© 2024 Southbank Investment Research Limited.