Sorry… Time is up.

Call to order: 0330 808 7916

(Mon-Fri 10am-10pm)

Join Britain’s longest-running investment advisory and receive all of this for JUST £24.99

- Your complimentary e-book: “Threat Zero – the dark side of going green and how smart investors can profit’

- Special report: “The ONE Net Zero Stock to Avoid at all costs”

- Your urgent Energy Investing Action Plan: containing the names and ticker symbols of the FOUR stocks to buy today

- Exclusive 6-part video series: “Not Zero – exposing the truth behind the Net Zero delusion”

- And 3 month’s membership of The Fleet Street Letter – FOR JUST £24.99

You’re about to join over 8,000 fellow investors at Britain’s longest-running investment advisory.

That’s right.

Take up my invitation today and you will receive 3 month’s membership of Britain’s longest-running investment advisory, on the best deal we have ever launched.

You’ll have your own personal copy of new book, ‘Threat Zero’…

And all the urgent details on our top 4 energy stock to buy today.

Plus, during your 3 month subscription, you‘ll be able to enjoy the monthly issues, 24/7 access to the private members website, the research reports, the recommendations and portfolio updates.

And the timing could not be better.

Because you will put yourself in pole position to potentially profit from an epochal super-trend in the energy and resource markets.

Trillions of dollars, pounds and euros are flooding into the all-important energy sector. Some $125 TRILLION.

And while past performance is not a reliable indicator of future results…

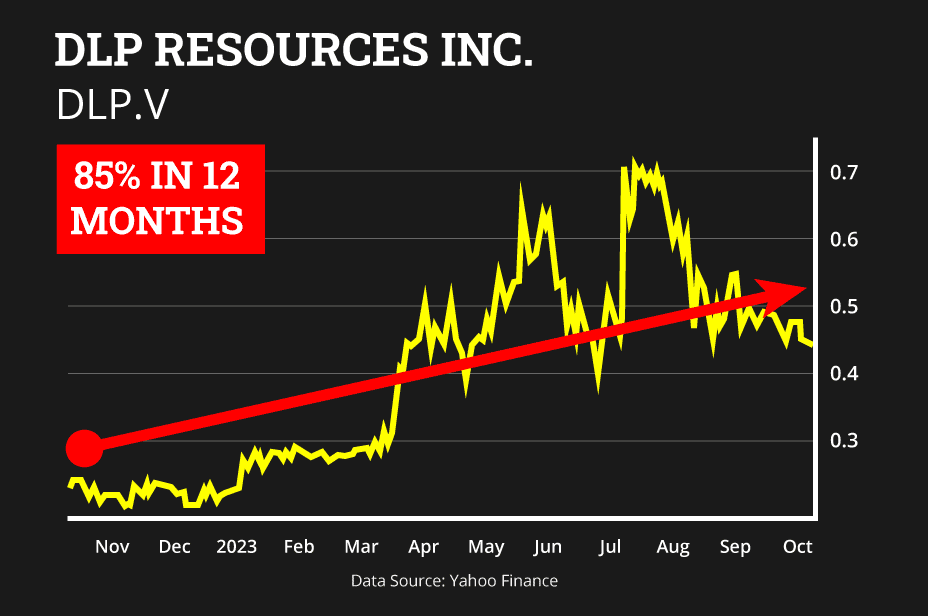

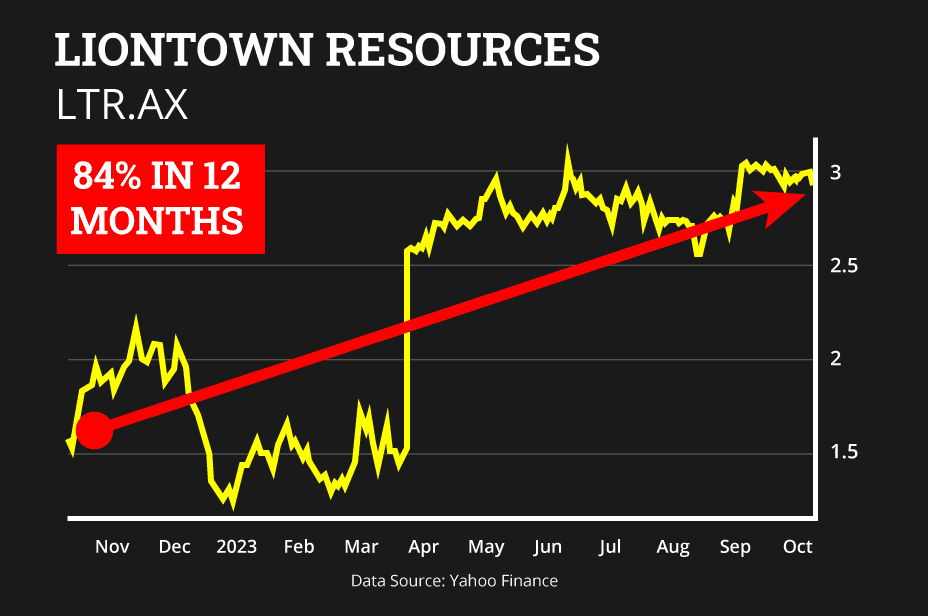

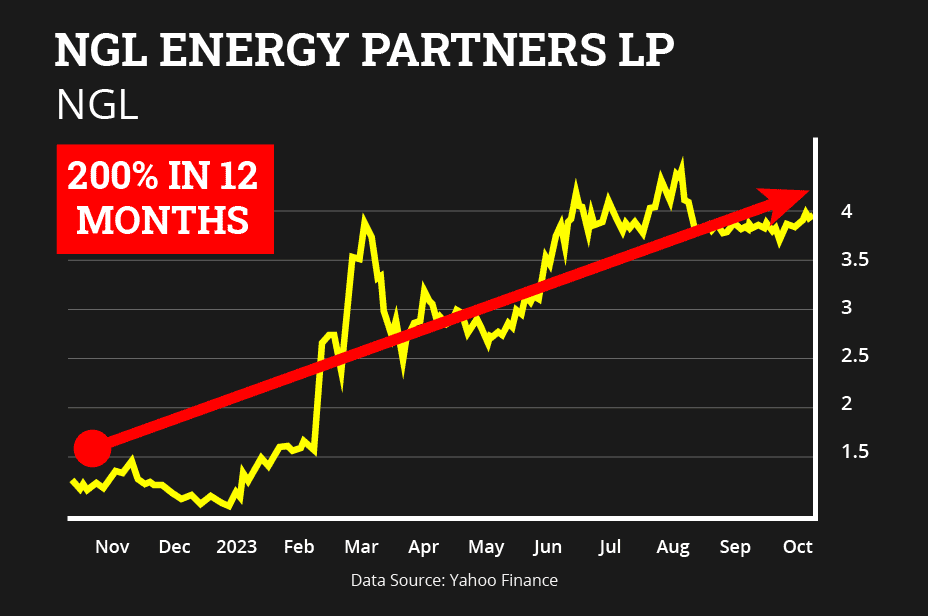

The impact this colossal influx of money is having on certain stocks should not be ignored.

Whether you’re a green energy believer… or you think it’s a load of hogwash… it really doesn’t matter.

This transition is already having a massive impact on a series of energy and mineral stocks, as demand surges.

Of course, forecasts are not a reliable indicator of future results – and not every stock will go up. The energy market is volatile and high risk.

Which is why I would like to give you the chance to try us out at an absurdly low price…

Test drive the service – for 90 days – for JUST £24.99

That’s right you get to enjoy all of this - obligation-FREE:

You’ll have 90 days to read our monthly issues, all and any of our research reports, books, guides and video interviews.

It will give you time to see why we get so much positive feedback like this:

“This is critical information for anybody who wishes to successfully navigate the tricky investment waters of today.” Glyn Williams

“You have given me the big picture of everything, which Financial Advisors do not discuss – all of the information is valuable to me.” Glenis Kellet

“I based my mortgage decision on The Fleet Street Letter’s forecast and it proved to be remarkably accurate.” Ian Carrington

If you find it valuable and useful – do nothing.

The customer service team will simply renew your membership for another 3 months – at exactly the same rate: £24.99.

That’s 90-day’s membership for £24.99.

Which means, if you renew every quarter for the first year, you are receiving 12 months membership for just £74.97 – instead of the full annual membership price of £249.

It is an unbelievably good deal.

I will even give you a 14-day moneyback guarantee – so if you get cold feet after a couple of weeks, you can cancel your three-month membership and get every penny of your £24.99 back.

Put like that, it seems a little absurd, doesn’t it?

Less than £20 for three months access to 85 years of wealth-building secrets from an extraordinary network of insiders – and a direct line to an award-winning investment director with close to $1 BILLION in assets under management.

If you care about what happens to your money…

If you believe you shouldn’t put all your eggs in one basket...

If you believe there are two sides to every story…

And you want to make more informed decisions when it comes to investing...

Give The Fleet Street Letter a try, today.

The terms I am offering are unprecedented!

Just fill in your details below.

Important note: Your subscription comes with our automatic-renewal feature. This feature ensures that you will never miss an issue. Normally The Fleet Street Letter renews at £249 per year for 12 months. You will automatically renew every 3 months – for just £24.99. You may opt out of this auto-renew feature at any time after your purchase.

Or call our customer care team on 0330 808 7916 between 10am-10pm Monday to Friday to claim this deal over the phone.

By clicking Subscribe Now, you agree to be bound by our terms and conditions, which can be viewed by clicking the link at the bottom of the page

Important Risk Warnings:

Advice in The Fleet Street Letter does not constitute a personal recommendation. Any advice should be considered in relation to your own circumstances, investment objectives and risk tolerance. Before investing you should consider carefully the risks involved, including those described below. If you have any doubt as to suitability or taxation implications, seek independent financial advice.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid.

Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds – Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment.

Bonds – Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation – Profits from share dealing, including both capital gains and dividends, are subject to capital gains tax and income tax respectively. Interest received from bonds is subject to income tax.

Capital gains from commodities are subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change in the future.

The Financial Conduct Authority does not regulate certain activities, including the buying and selling of commodities such as gold, and investments in cryptocurrencies. This means that you will not have the protection of the Financial Ombudsman Service or the Financial Services Compensation Scheme.

Investment Director: Eoin Treacy. Editor-in-Chief: Nick Hubble. Editors or contributors may have an interest in shares recommended. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of Southbank Investment Research Limited. Full details of our complaints procedure, privacy policy and terms and conditions can be found at www.southbankresearch.com.

The Fleet Street Letter is issued by Southbank Investment Research Limited.

Registered in England and Wales No 9539630. VAT No GB629 7287 94. Registered Office: 2nd Floor, Crowne House, 56-58 Southwark Street, London, SE1 1UN.

Contact Us To contact customer services, please call us on 0203 966 4580, Monday to Friday, 10am - 5pm.

Southbank Investment Research is authorised and regulated by the Financial Conduct Authority. FCA No 706697. https://register.fca.org.uk/.

© 2023 Southbank Investment Research Limited.